Saudi Arabia, traditionally known for its vast oil reserves, is now turning its attention to clean technology as part of its broader efforts to diversify its economy. With the launch of Saudi Vision 2030, the Kingdom is making significant strides to reduce its reliance on fossil fuels and invest in renewable energy and sustainability. This shift presents a unique opportunity for investors looking to tap into the growing clean tech market in the Gulf region.

Why Saudi Arabia is Embracing Clean Tech

Saudi Arabia’s economy has been historically dependent on oil exports, but this dependence has become increasingly unsustainable in the face of global pressure to reduce carbon emissions and adopt renewable energy. Vision 2030, the country’s blueprint for economic diversification, is driving this transformation. One of the main pillars of the plan is to invest heavily in renewable energy, with a focus on solar, wind, and hydrogen power.

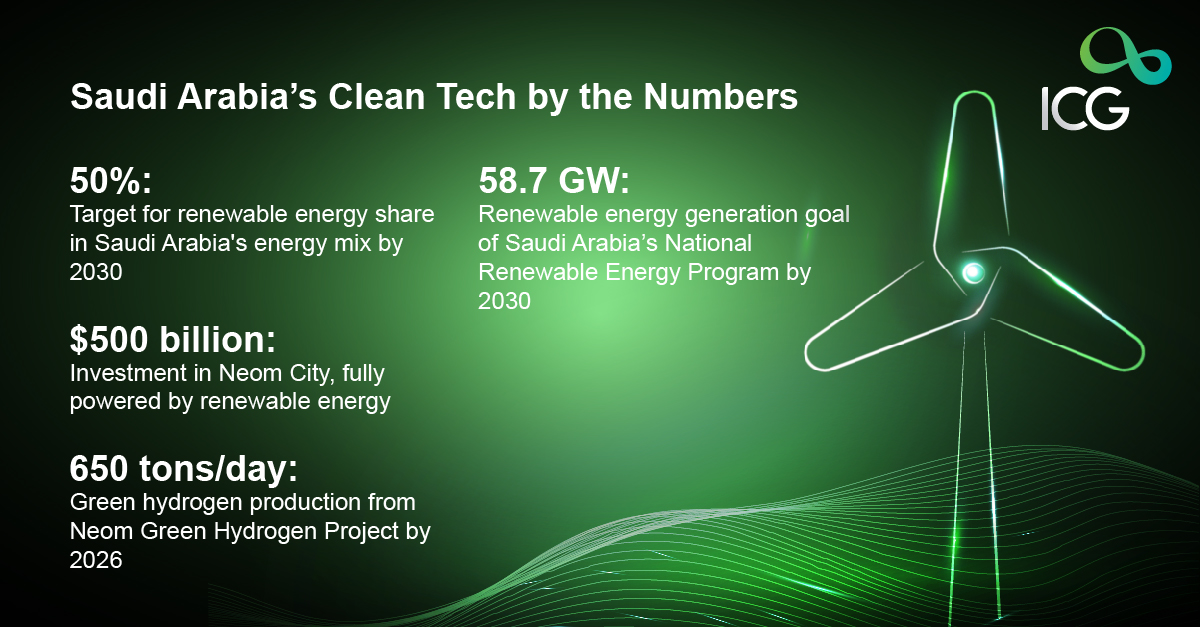

The Kingdom aims to generate 50% of its energy from renewable sources by 2030, which presents a massive opportunity for clean tech investors. According to McKinsey, Saudi Arabia could attract $150 billion in renewable energy investments by 2030 as part of its drive to become a clean energy powerhouse.

Interesting Fact: Saudi Arabia is home to the world’s largest solar project, the $500 billion Neom City, which is designed to be fully powered by renewable energy.

Key Investment Opportunities in Saudi Clean Tech

Solar Energy: Saudi Arabia has an abundance of sunlight, making solar power a prime area for investment. The country is already working on massive solar energy projects, such as the Sudair Solar Plant, which is set to be one of the largest in the world, producing 1.5 gigawatts (GW) of energy.

Why Invest:

- The Kingdom receives 3,000 hours of sunlight annually, making it an ideal location for solar power generation.

- Falling costs of solar technology and government-backed incentives make the sector highly attractive.

- Projects like the King Abdullah City for Atomic and Renewable Energy (KACARE) are paving the way for large-scale solar power generation.

Wind Energy: Wind energy is another burgeoning sector in Saudi Arabia’s clean tech landscape. The Kingdom is strategically located to harness strong wind currents, particularly in the Red Sea region. The Dumat al-Jandal wind farm is already operational, with a capacity of 400 megawatts (MW), and more projects are in the pipeline.

Why Invest:

- Saudi Arabia’s strategic location gives it access to some of the most powerful wind resources in the region.

- Wind energy is seen as a key component in the Kingdom’s renewable energy mix, offering long-term growth potential.

- Green Hydrogen: One of the most exciting opportunities in Saudi Arabia’s clean tech space is green hydrogen. The Kingdom is positioning itself as a global leader in hydrogen production, using renewable energy to produce clean, sustainable hydrogen for export.

The Neom Green Hydrogen Project, expected to be operational by 2026, will produce 650 tons of green hydrogen per day, making it one of the largest projects of its kind.

Why Invest:

- Global demand for hydrogen is expected to grow, with markets like Europe and Asia leading the way.

- The Neom project has the potential to put Saudi Arabia at the forefront of the global hydrogen economy.

- Energy Storage and Smart Grids: As Saudi Arabia increases its reliance on renewable energy, efficient energy storage and smart grid technology will become crucial for ensuring grid stability. Companies investing in advanced battery technologies and smart grid infrastructure can capitalize on this growing need.

Why Invest:

- Energy storage is critical for balancing the intermittent nature of renewable energy sources like solar and wind.

- The Saudi government is keen on integrating smart grid technology to modernize its energy infrastructure.

Challenges Facing Clean Tech Investments in Saudi Arabia

While the opportunities for investing in clean tech in Saudi Arabia are vast, there are challenges that investors must be mindful of:

Regulatory and Policy Uncertainty: Although Vision 2030 outlines a clear commitment to renewable energy, the regulatory framework surrounding clean tech investments is still evolving. Investors must stay informed about policy changes that could impact the sector.

Dependence on Government Support: A large portion of the clean tech sector in Saudi Arabia relies on government funding and incentives. The stability of these incentives could be influenced by fluctuations in global oil prices or changes in government priorities.

Technological Risk: While solar, wind, and hydrogen are proven technologies, the clean tech sector still faces risks from emerging technologies that may not yet be fully viable on a large scale. For example, green hydrogen is still in its early stages, and scalability remains a challenge.

Geopolitical Risks: The Middle East is a region known for its geopolitical volatility. While Saudi Arabia has been relatively stable, investors must factor in potential risks related to political developments or regional tensions.

Government Initiatives and Support

To attract foreign investors and drive growth in the clean tech sector, the Saudi government has implemented several initiatives:

- National Renewable Energy Program (NREP): This initiative aims to develop 58.7 GW of renewable energy by 2030, divided into 40 GW of solar and 16 GW of wind.

- Saudi Investment Recycling Company (SIRC): The company is focused on promoting sustainability and waste-to-energy technologies.

- Public Investment Fund (PIF): The PIF is heavily investing in renewable energy projects, including solar, wind, and hydrogen.

These initiatives underscore the Kingdom’s commitment to transitioning towards a more sustainable energy future, making Saudi Arabia a favourable environment for clean tech investments.

Effective Investment Strategies for Saudi Arabia’s Clean Tech Sector

Long-Term Commitment: Clean tech investments in Saudi Arabia will require a long-term view. Many projects, such as the development of Neom City and green hydrogen infrastructure, will take years to complete but offer significant future returns.

Public-Private Partnerships (PPPs): Investors can benefit by forming partnerships with the Saudi government or local businesses. The Kingdom is actively encouraging PPPs to help drive the clean tech transition.

Diversification Across Technologies: Investors should consider diversifying their portfolios across various sectors, such as solar, wind, hydrogen, and energy storage, to mitigate risks associated with individual technologies.

Focus on Innovation: Saudi Arabia is heavily investing in research and development (R&D) to innovate clean tech solutions. Investors who back companies or projects that are pioneering new technologies stand to benefit in the long run.

Saudi Arabia’s clean tech revolution presents an exciting and unique opportunity for investors. With Vision 2030 as the driving force, the Kingdom is set to become a major player in renewable energy, green hydrogen, and energy storage. Although there are challenges, such as regulatory uncertainty and technological risks, the potential rewards far outweigh the risks. By adopting a long-term investment strategy and aligning with government initiatives, investors can play a pivotal role in Saudi Arabia’s journey towards a sustainable future.

The ICG Approach

At ICG, we offer a customized approach that empowers your teams with the latest insights and technology expertise to navigate the demands of today’s digital age. As Saudi Arabia embarks on its digital transformation journey, ICG plays a pivotal role in shaping the Kingdom’s tech landscape by providing cutting-edge solutions, strategic consultancy, and fostering innovation. Our comprehensive guidance, from fundamental concepts to practical implementation, helps organizations mitigate risks, stay ahead of the competition, and unlock their full potential in the accelerating digital environment.

Ready to talk?

Request your free Consultation to learn more about ICG’s capabilities and enablement to embark on a transformative expedition toward the summit of success.