As climate change dominates the global conversation, clean technology (clean tech) has emerged as one of the most promising sectors for investors. Clean tech refers to products and services that aim to reduce negative environmental impacts. It includes renewable energy, electric vehicles (EVs), sustainable agriculture, and energy-efficient buildings. With rising global demand for sustainability and a supportive regulatory environment, clean tech presents enormous investment opportunities.

Why Clean Tech Is on the Rise

Governments, businesses, and consumers are increasingly prioritizing environmental sustainability, creating a huge demand for clean technologies. According to McKinsey, investments in clean energy could rise to $6 trillion annually by 2030, driven by commitments from governments like the EU’s Green Deal and the Biden administration’s climate agenda in the U.S. These initiatives focus on reducing carbon footprints, improving energy efficiency, and accelerating the adoption of renewable energy sources like solar, wind, and hydrogen.

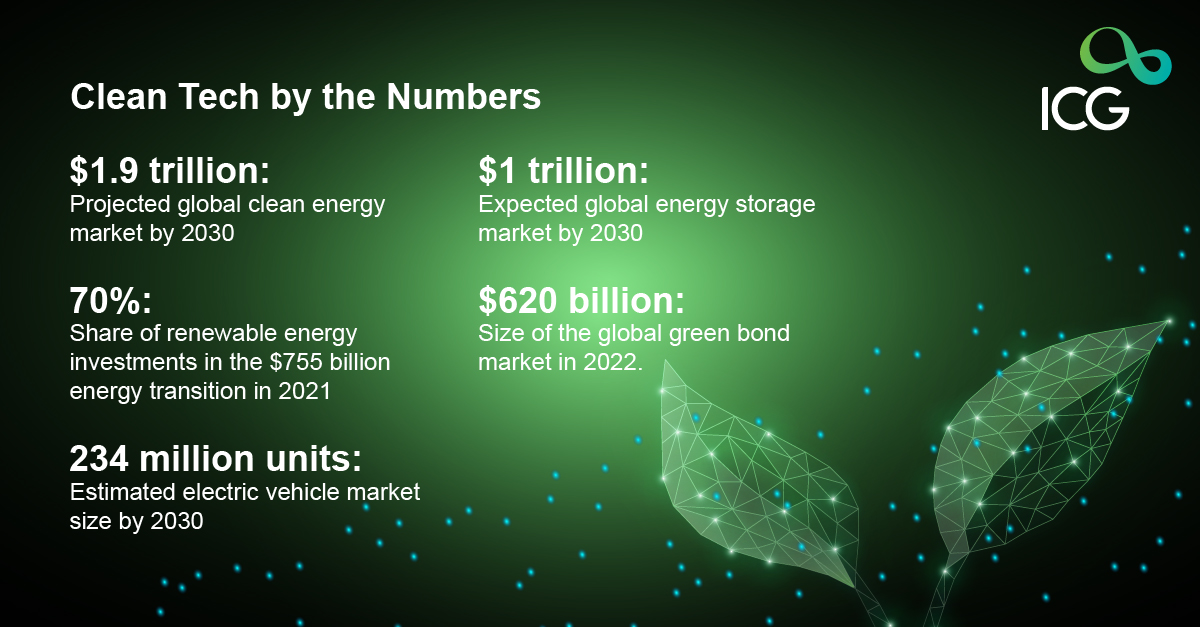

Interesting Fact: The global clean energy market is projected to reach $1.9 trillion by 2030, growing at a CAGR of 10.2% from 2020 to 2030, according to Statista.

Key Investment Opportunities

Renewable Energy: Solar and wind energy are two of the fastest-growing segments within the clean tech sector. Solar power installations are expected to triple by 2030, while wind power has been expanding offshore. BloombergNEF reports that wind and solar energy investments accounted for 70% of the $755 billion invested in the energy transition in 2021.

Why Invest:

- Decreasing costs: Solar and wind technologies are becoming cheaper due to advances in technology.

- Strong regulatory support: Policies like tax incentives and government subsidies favor investment in renewables.

- High demand: Corporations like Google and Amazon have committed to sourcing 100% of their energy from renewables in the coming decade.

Electric Vehicles (EVs): The electric vehicle market is growing rapidly, driven by a combination of regulatory pressure to reduce emissions and consumer interest in greener transportation options. According to Gartner, the EV market could reach 234 million units by 2030, with major automakers transitioning to all-electric fleets.

Why Invest:

- Major automakers are betting big on EVs: Companies like Tesla, General Motors, and Ford are ramping up production.

- Government incentives: Many countries offer tax breaks, rebates, and infrastructure development for EV adoption.

- Battery innovation: Significant advances in battery technology are reducing costs and improving range, making EVs more viable.

Sustainable Agriculture: contributes significantly to global emissions, but innovations like vertical farming, precision agriculture, and lab-grown foods are transforming the industry. Investors have started pouring money into companies developing sustainable food technologies to reduce water usage, greenhouse gas emissions, and waste.

Why Invest:

- Growing consumer demand for sustainable products.

- Technological advancements like AI and IoT that optimize water and fertilizer use, making farming more sustainable.

- Increased global food security through efficient practices. Energy Storage: As renewable energy sources like solar and wind gain traction, the need for reliable energy storage becomes critical. Energy storage technologies, such as lithium-ion batteries and hydrogen fuel cells, are key to balancing supply and demand for clean energy.

Why Invest:

- Grid resilience: Storing energy ensures a continuous supply even when the sun isn’t shining or the wind isn’t blowing.

- Technological advancements: Battery efficiency is improving while costs are declining.

- Growing market demand: The global energy storage market is expected to grow by $1 trillion by 2030.

Effective Investment Strategies

- Diversification: As with any sector, diversification is key to managing risk in clean tech investments. Spread your capital across various industries, including solar, EVs, energy storage, and sustainable agriculture. This ensures you aren’t overly reliant on one segment’s success.

- Green Bonds: Green bonds have become a popular investment tool for clean tech. These bonds are issued to finance projects that have a positive environmental impact. The global green bond market reached $620 billion in 2022, and it continues to grow as investors look for sustainable returns.

Long-Term Investment Horizon: Clean tech investments often require patience. While some technologies may take time to scale or receive widespread adoption, the long-term potential is immense. For example, energy storage and hydrogen fuel cells are still developing, but they are critical to future energy systems.

Venture Capital (VC) and Private Equity: Venture capital and private equity firms are leading the charge in funding early-stage clean tech companies. According to PitchBook, VC investment in clean tech reached $16 billion in 2022, up from $12 billion the previous year. These firms often seek out companies with disruptive technologies that can reshape the market.

The Risks to Consider

While the clean tech sector offers vast opportunities, it also presents challenges. One key risk is technological failure. Some emerging technologies, like hydrogen fuel cells or advanced carbon capture, are still in development. Investors should stay informed about the progress of these technologies and adjust their portfolios accordingly.

Government policy also plays a significant role in clean tech investment. Regulatory changes, such as the rollback of environmental policies, could impact the growth potential of certain segments. Monitoring global political trends is crucial for staying ahead of such risks.

Conclusion

The clean tech sector represents a pivotal opportunity for investors seeking sustainable returns while contributing to a greener future. Whether you’re looking to invest in renewable energy, electric vehicles, or sustainable agriculture, the key is understanding the market, diversifying your portfolio, and adopting a long-term view. With the right strategies, investors can capitalize on this growing industry and support the transition to a low-carbon economy.

The ICG Approach

At ICG, we offer a customized approach that empowers your teams with the latest insights and technology expertise to navigate the demands of today’s digital age. As Saudi Arabia embarks on its digital transformation journey, ICG plays a pivotal role in shaping the Kingdom’s tech landscape by providing cutting-edge solutions, strategic consultancy, and fostering innovation. Our comprehensive guidance, from fundamental concepts to practical implementation, helps organizations mitigate risks, stay ahead of the competition, and unlock their full potential in the accelerating digital environment.

Ready to talk?

Request your free Consultation to learn more about ICG’s capabilities and enablement to embark on a transformative expedition toward the summit of success.